Bittensor Halving, Stablecoins, and Gulf Capital Collide

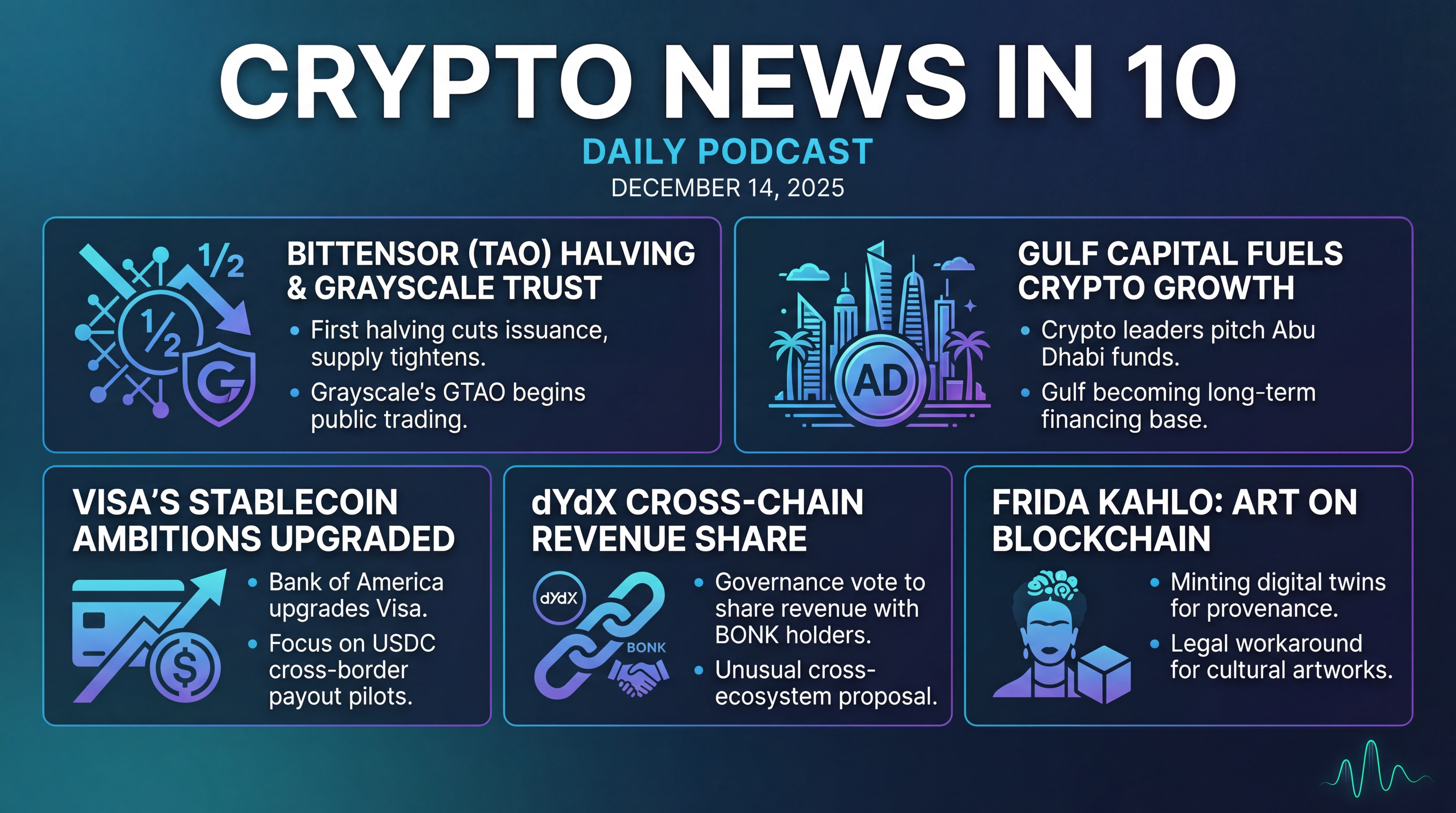

Bittensor’s first halving lands the same week Grayscale’s GTAO begins public trading, tightening supply and broadening access. Plus: Abu Dhabi’s sovereign funds court crypto, Visa’s stablecoin push accelerates, dYdX weighs BONK revenue sharing, and Frida Kahlo digital twins bring provenance to restricted art.

Episode Infographic

Show Notes

Welcome to our Crypto news in 10, a daily podcast bringing you the latest news about crypto in under 10 minutes.

Here’s what’s moving crypto on Sunday, December 14, 2025...

We’ve got a milestone for decentralized AI: Bittensor hits its first halving today, cutting TAO issuance and tightening supply... just as Grayscale’s Bittensor Trust began public trading this week.

In macro and capital flows, the Wall Street Journal reports crypto leaders are increasingly pitching Abu Dhabi’s sovereign wealth funds — a sign the Gulf is becoming a long-term financing base for the industry.

On the payments front, Bank of America just upgraded Visa, pointing squarely to the card giant’s stablecoin ambitions — remember those U-S-D-C cross-border payout pilots.

In DeFi, dYdX wrapped a governance vote that would share order-router revenue with BONK token holders — an unusual, cross-ecosystem twist.

And in culture meets crypto, the Frida Kahlo Foundation is minting blockchain digital twins of artworks, offering collectors provenance with a legal workaround for pieces that can’t leave Mexico. Let’s jump in...

[BEGINNING_SPONSORS]

Story one — Bittensor’s first halving lands today.

The AI-crypto network, built around competing subnets for model inference and data, sees daily TAO issuance fall from roughly 7,200 to about 3,600 as the system crosses the 10.5 million TAO threshold — half of its 21 million max supply. Unlike Bitcoin’s block-height schedule, Bittensor’s halving triggers when total issuance hits preset levels, and network recycling dynamics can nudge the exact date — hence today’s on-or-around December 14 timing.

If you follow tokenomics, fewer new tokens hitting the market can reduce structural sell pressure — though demand still has to show up. Bittensor’s official documentation confirms both the supply cap and the halving mechanics.

What’s new for access? Grayscale’s Bittensor Trust — ticker GTAO — began publicly quoted trading on O-T-C-Q-X on December 11, and the firm says it is now S-E-C reporting. As of December 12, Grayscale shows about 10.5 million dollars in assets under management, non-GAAP, with a 2.5% expense ratio. For investors who can’t, or don’t want to, self-custody TAO, that’s a conventional wrapper arriving right as supply tightens. Grayscale frames Bittensor as exposure to decentralized AI subnets and timed the O-T-C debut ahead of the halving. As always with closed-end products, watch for potential premiums or discounts to N A V.

Story two... follow the money — to Abu Dhabi.

The Wall Street Journal reports a steady procession of crypto executives courting Emirati sovereign wealth funds at recent Abu Dhabi finance gatherings, as the U.A.E. leans into becoming a digital finance hub. For teams facing tighter funding in Western markets, the region’s patient capital and increasingly clear rules are a compelling draw — though veterans caution that quick wins are rare, and relationship-building matters.

Big picture, the Gulf’s appetite could shape who gets funded in 2026 — exchanges, AI-crypto, tokenization rails — and tilt where new compliance standards get set.

Story three: stablecoins — and TradFi — keep inching closer.

Bank of America just upgraded Visa to buy, pointing to upside from the network’s deeper work with dollar-backed stablecoins. Visa’s recent pilots with Circle’s U-S-D-C — for rapid international payouts to freelancers and small businesses — show how card networks can use blockchain rails without changing the consumer experience. The upgrade also cited manageable regulatory risk and a pipeline that could make stablecoin settlement a meaningful revenue driver, not just an experiment.

It’s a reminder: if mainstream rails adopt stablecoins on the back end, crypto utility grows even when the front end looks like tap and go.

[MIDPOINT_SPONSORS]

Story four — a notable governance wrinkle at dYdX.

From December 11 to 13, dYdX community members voted on Proposal 325, which would add order-router revenue sharing specifically for BONK holders — yes, the Solana memecoin community — introducing a cross-ecosystem revenue tie. Supporters say tapping BONK’s large user base could funnel activity back to dYdX; critics worry it dilutes rewards that currently flow to stakers and core participants. The vote closed late Saturday; as with all on-chain governance, final execution depends on the formal tally and implementation steps.

Context: dYdX has been experimenting with buybacks and fee allocation this year, so the D-A-O seems willing to test incentive designs aimed at growth — even if they’re unconventional.

Story five — culture on-chain, without the hype.

The Frida Kahlo Foundation is rolling out blockchain digital twins of artworks with partner LMNL. Why it matters: Mexican federal law restricts the export of culturally significant works, which complicates global exhibitions and private loans. The Foundation’s model lets collectors donate physical works for display while receiving a blockchain-verified twin — complete with provenance — that keeps them economically and symbolically connected to the piece, and can confer a tax benefit. This isn’t your 2021 avatar drop — this is NFT tech used as a certificate of authenticity and rights conduit in a high-stakes legal context. MarketWatch framed it as a possible blueprint for institutions that want access, compliance, and modern tracking in one package.

A few rapid-fire context notes before we wrap...

Bittensor’s halving doesn’t guarantee a price reaction — some analysts expect “sell the news” and point to fundamentals like subnet adoption to drive demand — but supply cuts are mechanically real, and a public vehicle like GTAO broadens the buyer base that can express a view.

For funding, the Gulf’s role is likely to grow: a friendlier policy stance and capital depth can offset cyclical risk, while nudging projects toward stronger governance and compliance from the start.

On payments, Visa’s stablecoin steps aren’t isolated — expect peers and banks to keep testing tokenized money and tokenized assets in 2026, especially after this season’s regulatory green lights.

That’s the run for today: Bittensor halves as GTAO goes public, crypto leaders work the Abu Dhabi corridor, stablecoins keep slipping into mainstream rails, dYdX experiments with a cross-chain revenue share, and the Frida Kahlo Foundation gives us a serious, practical use case for blockchain in the arts. We’ll keep watching how these threads — AI-crypto, tokenization, and real-world utility — intertwine as we head into the last trading weeks of 2025.

Thanks for listening and see you tommorow!